Residential VS Commercial – Where You Should Invest in Pakistan?

Difference Between Residential VS Commercial Properties

Choosing between commercial and residential real estate investing is not an easy option to make. Each option comes with its own set of advantages as well as challenges. The path taken by an investor is determined by their objectives, risk tolerance, and time frame.

Before making any investment in real estate, a person is clear about what sector or niche he wants to invest in.

The real estate industry is basically categorized into two types:

- Residential

- Commercial.

Residential Real Estate

Residential plots or property refers to the real estate where all single and family type buildings are located or under construction. Houses, apartments, and flats are all categorized as residential property.

Commercial Real Estate

Commercial plots are those where offices, industries, and buildings assigned for business purposes are located.

Both categories have clearly marked differences between them.

If a person wants to invest in property with the foresight of building a home in upcoming years, investing in areas that come under the category of commercial real estate will not be a wise decision. Therefore, it is necessary to do background research on the difference between both kinds of properties and figure out a proper channel for investing in either of them.

Both kinds of investments have their pros and cons and come with different kinds of benefits and challenges.

No need to look any further because we have a comparison for you.

This blog will go through the features, benefits, and drawbacks of both properties in detail so that you may make a more informed decision.

So, let’s dive into the details of this comparison.

Comparison Between Residential VS Commercial Property

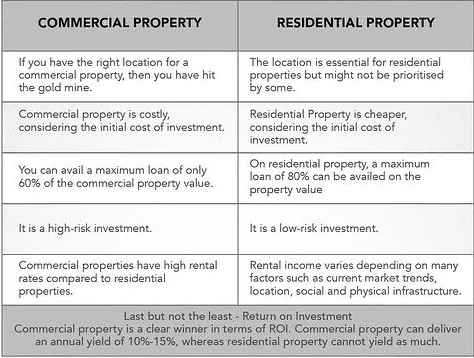

There are benefits and drawbacks to both residential and commercial spaces. Commercial properties, while yielding significant rental returns, are also more expensive than residential homes. Residential properties, on the other hand, are typically purchased as a long-term investment.

The demand for commercial space has increased dramatically. As a result, the price of commercial space has continuously increased.

Property Value

The capital and rental values of commercial real estate are increasing at the moment. Residential real estate, on the other hand, has remained relatively static in recent years, owing to frequent modifications and abundant supply.

Return on Investment (ROI)

In terms of return on investment, commercial property is the clear victor. It’s crucial to note that commercial property can yield between 10% and 15% annually, whereas residential property can never yield more than 4%.

Tax Incentives

Figures may differ, but there is always a big difference between the two. Another point that many people overlook is that there are no tax incentives available on commercial property loans. Residential property loans, on the other hand, come with tax advantages.

Laws

In terms of design, structure, construction by laws, and rental agreements, residential property owners typically have a lot more freedom. It is also simpler to construct a residential home because zoning and planning licenses are not required.

If you decide to buy a commercial property, however, the laws and regulations become more strict, and you’ll have to overcome various obstacles to obtain the necessary approvals to develop and design as you wish.

Maintenance

Residential properties are less expensive to maintain than commercial properties, partly because your tax rate changes if you declare yourself as the owner of a commercial property. As a result, you’ll not only pay more taxes, but you’ll also pay more for utilities, as is the case with all commercial establishments because their overheads are often higher.

Overall, there is no clear winner; it is a matter of personal preference and needs. Commercial property investment is a good choice if you desire high risk and high profits. A home investment, on the other hand, will fit you best if your goal is stability at the expense of modest returns.

Advantages of Investing in Commercial Property

Before making a final investment decision, smart investors understand the necessity of weighing all the advantages and disadvantages. These advantages of commercial real estate investing, on the other hand, are undeniable.

Higher Returns

You’ve probably heard the phrase “more risk, greater reward,” and this is certainly true when it comes to commercial properties and higher returns. Commercial property cash flow and returns are significantly more appealing than residential property cash flow and returns.

Suitable Residents

It might be difficult for investors wishing to rent out a single-family home to locate qualified tenants who will keep the property in good condition. Commercial renters, on the other hand, are usually businesses, corporations, or similar entities. Because they are backed by a larger corporation, they are more inclined to respect the property and its rules.

Longer Lease Terms

Commercial leases are often significantly longer than residential leases, which normally last six to twelve months. Commercial premises are frequently leased for periods of five to ten years.

For investors, this means lower vacancy rates and turnover costs. For investors concerned about promoting a home from year to year, the long lease agreements suggest consistent, positive cash flow. For long periods of time, commercial investors may be stuck with unsuitable renters.

Property Value is Easier to Increase

Property values are set differently in residential and commercial real estate. While comparable properties have a big influence on residential real estate, revenue has a big impact on commercial real estate.

Simply, the bigger the amount of cash flow a commercial property generates, the higher its value. Investors might experience a much faster increase in value than residential housing with the right tenants.

Advantages of Investing in Residential Property

Both business and residential real estate have advantages and disadvantages. Review the benefits and analyze which ones correspond more with you and your company’s fundamental beliefs to determine whether the strategy is suitable for you.

Cost of Entry

While it is feasible to secure commercial real estate loans as a beginner investor, the cost of investing in residential real estate is far cheaper – at least at first.

The average person may not have enough money to put down on a commercial property, but they are considerably more likely to have enough money to put down on a single-family house.

Performs Better in Economic Crisis

Businesses are generally the first to feel the effects of an economic downturn, which can affect commercial investors in a variety of ways.

First, commercial property owners seeking to attract renters during a downturn may find marketing the property particularly difficult.

Residential real estate is not immune to these issues; nonetheless, residential property owners as a whole will benefit from the fact that housing is constantly in demand.

Conclusion

When deciding between commercial and residential investments, there are various factors to consider. If you want to maximize your profits, you should consider investing in commercial real estateestate.

Residential homes, on the other hand, may appeal to you if you prefer working on a smaller scale. It’s easier to pick where to invest your money if you consider how much time you’re willing to devote to your project and your risk tolerance.

Keep your goals in mind while you make your decision, and remember that you may always switch to the other type later.

You can also invest in other famous and most in demand housing societies, such as , Blue World City, Rudn Enclave, 7 Wonders City Peshawar, Taj Residencia, Kingdom Valley, New Metro City Gujar Khan, Forest Town Rawalpindi, University Town Rawalpindi, ICHS Town, Park View City Islamabad, Multi Gardens B17 Islamabad and Nova City Islamabad.

Al Sadat Marketing please contact 0331 1110005 or visit https://alsadatmarketing.com/

Few more real estate housing schemes which are trending now a days in Islamabad by including: Faisal Town Phase 2, Prism Town Gujar Khan, New City Paradise, Eighteen Islamabad, 7 Wonders City Islamabad, Capital Smart City, Silver City Islamabad, The Life Residencia, Faisal Town Islamabad, Islamabad Golf City, Islamabad Model Town and Marble Arch Enclave.

Al Sadat Marketing is an emerging Real Estate Agency headquartered in Islamabad, Pakistan. With over 10+ Years of experience, Al Sadat Marketing is providing its services and dealing all trending housing societies projects in different cities of Pakistan. Islamabad Projects, Rawalpindi Projects, Gujar Khan Projects, Burhan Projects, and Peshawar Projects etc.

Book Your Plot Now: +92 331 111 0005