Basics & Types of Real Estate Financial Modeling

Introduction

In the broad world of investing, real estate financial modelling plays a significant role. Furthermore, the phenomena is extensive and complex, making it possible that some people are unaware of it. As a result, the accompanying blog will clarify all the details and implications related to the term “Real Estate Financial Modelling” (REFM) and what it entails.

When considering a situation practically, REFM refers to both viewpoints simultaneously. Let’s first make things simple and take them one at a time. First off, by “real estate,” we mean lands and properties that produce income or at least have the potential to do so. One of the key areas of the business is REFM, where we either examine the property from the standpoint of the seller or the buyer. Check out this blog to see how it differs, what differences it has, and what kinds of REFM there are.

Read More: 5 Reasons to Invest in Low Income Housing Societies

Real Estate Market Strategies

It should come as no surprise that real estate, which spans a wide spectrum, significantly boosts the county’s entire economy. As a result, there are many different ways one can choose from to better explore this area. Furthermore, there is no substitute for sufficient knowledge, regardless of the many real estate investing techniques, real estate modelling, or anything else. Therefore, be informed and choose wisely based on the demands and needs of the market.

Real Estate Financial Modeling

The phrase “real estate financial modelling” (REFM) refers to examining or studying a property from the viewpoint of an investor or a buyer. In a nutshell, each party has a different perspective depending on whether they are an equity investor (owner) or a debt investor (buyer). Therefore, consider all of your possibilities, the associated dangers, and who might be in a position to invest more (the buyer or the investor).

As a result, REFM also considers future returns that may be possible. Let’s use a financial modelling example in real estate. Is there a probability that someone who purchases a piece of property for, say, $20 and keeps it will at least make $2 a year in profit?

Read More: Top 10 Real Estate Agencies in Pakistan

REFM

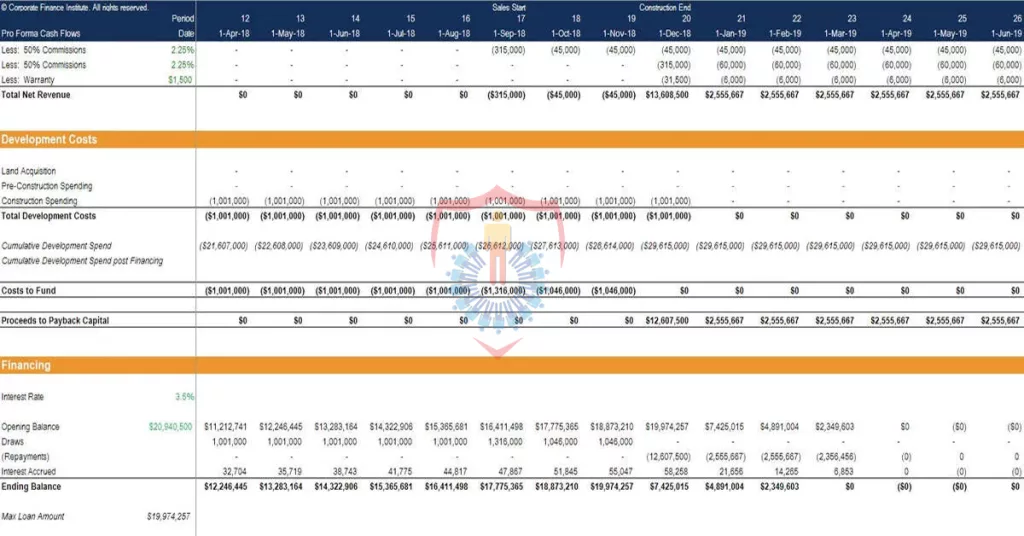

It is simpler to comprehend how real estate financial modelling aids in understanding issues and placing them in their overall context when the aforementioned example is taken into consideration. REFM examines the company’s net worth and expenditures, which will only influence decision-making in the future, using a straightforward spreadsheet.

Types of Real Estate Financial Modeling

The financial model is, first and foremost, a phenomena that conveys information about a company’s financial cash flow. The model also aids in understanding the hierarchy or patterns so that any future proposals can be made by a business or an individual. It aids people in making future financial decisions as well.

Additionally, the complexity of the complete model varies according to the size of the business or brand at large. To gain a complete understanding, you can also study about other adjectives like opportunistic real estate funds and more. But speaking about the risks associated with this subject, these are some of the major ones:

High-Risk Returns

If a property owner purchases a developed, well-maintained property, but the value of the property does not rise over time. The owner chooses to sell it in this instance and opts for high-risk rewards.

Low-Risk Returns

Lower tenancy rates indicate lower risk returns for the property. Therefore, even in this circumstance, if the owner chooses to renovate and refurnish the property, there won’t be many hazards if the owner chooses to sell.

Read More: 5 Ways to Avoid Investing in Fraudulent Societies

Risk Returns – Higher than Stocks

A third type describes a real estate corporation or organisation creating a business from scratch or purchasing a damaged or distressed property and refurbishing it. After then, selling it will involve a high level of risk.

Types

Here are the types of real estate financial modeling;

Real Estate Acquisition Modeling

This type refers to a company just buying the property, and doing very little in its upgradation. Then decide to sell it further.

Real Estate Renovation Modeling

In this type, the firm buys the property and renovates it fully. The upgradation process end which is then followed up by the sale.

Real Estate Development Modeling

The following type talks about the financial model for real estate development which is the building of a property from scratch. It involves everything – from sourcing land to its development and everything in between.

Conclusion

The phrase “real estate financial modelling” covers a wide range of occurrences. Therefore, it is important to have the right information to make a sensible choice. Otherwise, the overall risk ratio is probably going to be larger, which will have an effect on a person’s or a company’s financial situation. Connect with Al Sadat Marketing, which is always available, for more information.

You can also invest in other famous and most in demand housing societies, such as , Blue World City, Rudn Enclave, 7 Wonders City Peshawar, Taj Residencia, Kingdom Valley, New Metro City Gujar Khan, Forest Town Rawalpindi, University Town Rawalpindi, ICHS Town, Park View City Islamabad, Multi Gardens B17 Islamabad and Nova City Islamabad.

Al Sadat Marketing please contact 0331 1110005 or visit https://alsadatmarketing.com/

Few more real estate housing schemes which are trending now a days in Islamabad by including: Faisal Town Phase 2, Prism Town Gujar Khan, New City Paradise, Eighteen Islamabad, 7 Wonders City Islamabad, Capital Smart City, Silver City Islamabad, The Life Residencia, Faisal Town Islamabad, Islamabad Golf City, Islamabad Model Town and Marble Arch Enclave.

Al Sadat Marketing is an emerging Real Estate Agency headquartered in Islamabad, Pakistan. With over 10+ Years of experience, Al Sadat Marketing is providing its services and dealing all trending housing societies projects in different cities of Pakistan. Islamabad Projects, Rawalpindi Projects, Gujar Khan Projects, Burhan Projects, and Peshawar Projects etc.

Book Your Plot Now: +92 331 111 0005