How to Become a Tax Filer in Pakistan?

Of the 220 million people living in the country, only 1% actually pay taxes. Yes, Pakistan is the subject of the article, and the Federal Board of Revenue is the source of these figures.

It should therefore come as no surprise that every government strives to raise the number of current taxpayers by offering a variety of incentives.

Salaried Person- Income Tax Return

Declaration form 114(I) has been made available to make it easier for salaried individuals to file their income tax returns. For a salaried person to correctly file their income tax return, the Declaration form 114(I) must be finished.

This form is available to those whose only source of income is a salary and other sources, where the salary represents more than 50% of their total income.

Get Your NTN Number

You need an NTN in order to register as a filer. You can register yourself on the official FBR website if you don’t already have a registered NTN to your name.

To apply for your NTN, follow the directions on the registration portal.

You could find a registration form to complete in the draft folder. Once the form is finished, you can submit it online to obtain your NTN.

Once you have your NTN, you must file your tax return for the relevant year in order to register as a filer.

Prepare Your Wealth Statement

To be a filer in Pakistan as a tax resident, you must present your wealth statement and income tax returns.

You need to complete your wealth statement and income tax returns if you are a salaried individual. You can accomplish it by according to the guidelines provided at:

https://e.fbr.gov.pk/SOP/SideLinks/iris help.pdf

We really hope the information and guidelines above assist you in becoming a filer in Pakistan.

Documents Required for a Salaried Person to Become a Filer

- An image of your CNIC (National Identity Card) REMEMBER: It must be valid.

- A duplicate of a paid electric bill. NOTICE: It must be current, not more than three months old.

- Active email, mobile number, and landline contact information.

- Payslip.

- Your employer’s NTN number, workplace address, and email address (it should be VALID).

Step by Step Process to Become a Filer in Pakistan

Are you aware that you can start filing without the help of anyone else? Well! Below are the procedures for signing up as a filer on the FBR online site.

To preserve your progress, you must frequently click the save button.

Register with FBR/ Filer Registration

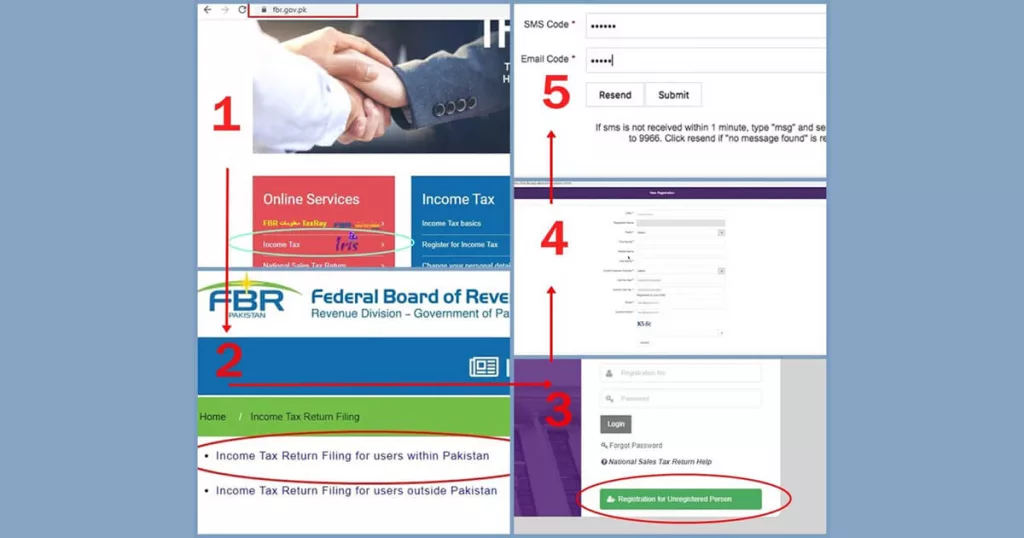

- Initially, visit the FBR website at https://www.fbr.gov.pk.

- Choose Income Tax or IRIS from the list of online services.

- There are two choices available for you to make. (We’ll show you how to submit a refund from inside Pakistan.)

- Income Tax Returns for Pakistani Users to File

- Tax Return Filing for Users Outside of Pakistan

- Go to the menu and choose “Registration for an Unregistered Person.”

- After filling out all the fields, click “Submit.”

- Codes will be delivered via SMS to the provided phone number and email address. They should both be included in the required fields.

- Your primary registration is now complete, and your password will be sent to you through email and SMS.

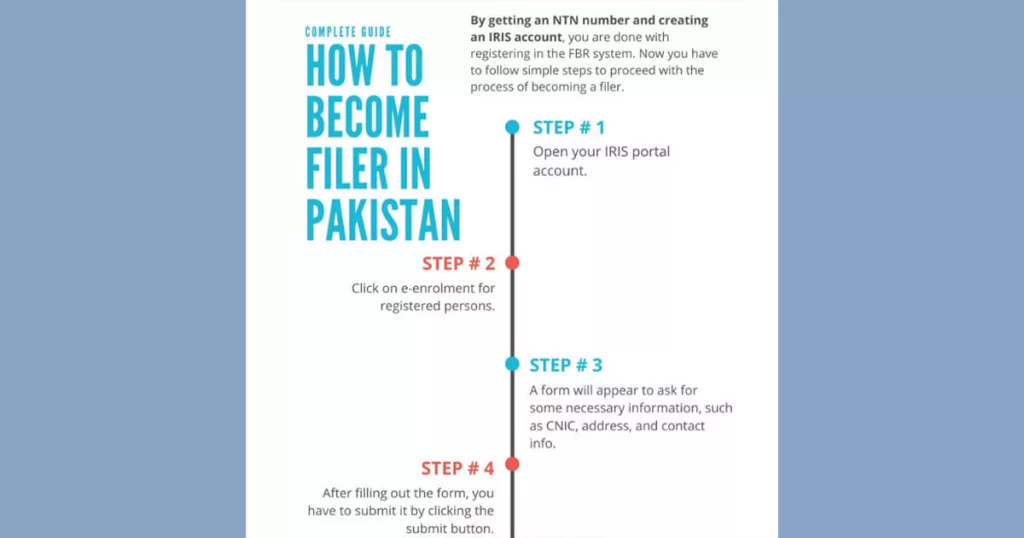

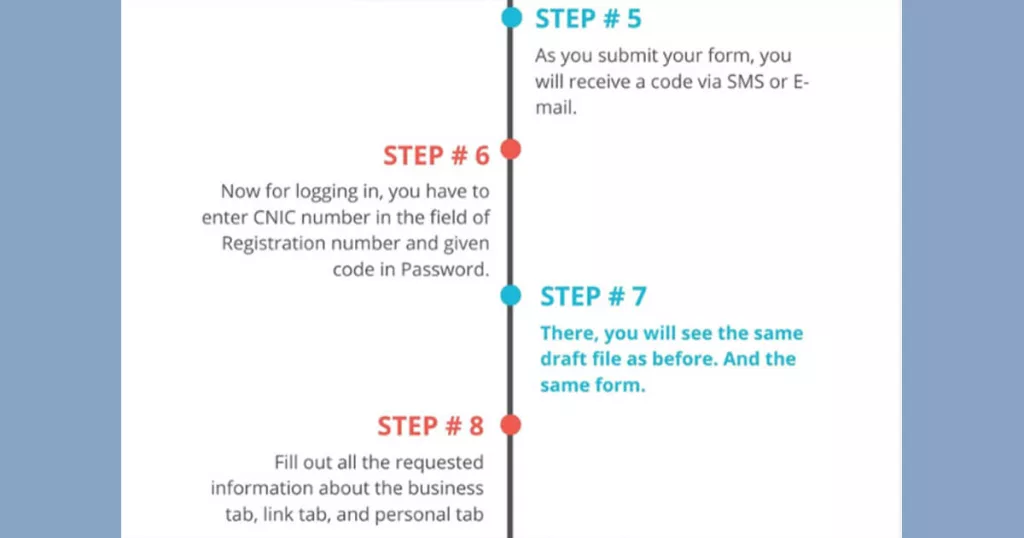

Complete Registration in FBR-IRIS

- For this step, you must log in at https://iris.fbr.gov.pk/public/txplogin.xhtml.

- After entering your CNIC (without the dashes) and the password that is required in the registration number area, click “Login”.

- Then, on the left side of the screen, click the Draft button. Then, click the Registration button.

- When you select form 181, it will get highlighted.

- It is necessary to select the Edit button.

- Five pieces will be included (Personal, Property, Business, Link, Attachment)

- Your information in the personal section will automatically be updated in accordance with the registration requirements.

- In the Property area, you must include a home, office, or other address where FBR can find you if necessary.

- Click the + sign to add an address.

- Enter the data accurately. * The home’s address is shown by the unit number; ownership is indicated by the capacity; and your ownership interest is indicated by the percent share. After finishing, click OK.

- Don’t forget to select option 8 in the checkbox. There is a business tab for people who own enterprises. For the time being, disregard it because we are not discussing filing for business persons.

- Use the Link option to add details about the company or employer where you work.

- Select Employer from the area titled Capacity.

- Click the search box next to the name area to look up and input the company name.

- Value the shares at 100%.

- The start date of the job should now be entered in the Start Date field.

- Now click OK.

- Choose the Save option. You can do this at any stage of the process.

- After you’ve double-checked everything, click Yes to complete the form. Be careful since after you submit the form, you cannot change the information. You’ve finished now. Your FBR registration has finished.

File Income Tax Returns to Become a Filer

- Before reporting taxes, you must first register with FBR. After registering, you can file returns by using these steps.

- On the IRIS FBR website, click the “Salary greater than 50% and other sources-Classic view” buttons after selecting the Declaration Tab.

- Choose the time period for which you want to file your tax returns right away.

- Include all relevant details about your compensation in the Employment and Salary Section (annual).

- In the tax-exempt column next to the pay, include any tax-exempt sums, such as medical costs.

- Add any annual allowances you get on top of your base income. Now click Calculate.

- The Other Sources Tab’s Receipt/Deductions option should be chosen.

- Fill in the appropriate boxes with your other sources of income, if any. Then, click Calculate.

- Choose international sources right now.

- Include foreign source revenue if appropriate (but leave out the remittance amount). Then, click Calculate.

- By choosing the Agriculture option, you can add your agricultural income (if any). Then, click Calculate.

- You should click the Tax Chargeable/Payments button.

- Choosing Tax Reduction (if you are a teacher or researcher, add the reduced tax amount).

- You can add all of the income taxes or advance taxes you’ve already paid by choosing the Adjustable Tax option and adding them where necessary.

- For instance, in the section labeled “Salary of Corporate Sector Employees,” you may include income tax paid on salaries.

- Contact the local branch of your telecom provider to learn how much income tax you have paid on using your cell phone. Put that amount in the proper place here.

- Add the previously paid income tax and the automobile token tax together (if any).

- Add all of the income taxes for the entire year in the same way. Then, click Calculate.

Calculation Time

- Click the “Final / Fixed / Minimum / Average / Relevant / Reduced Tax” button to include tax paid on the bank account, savings certificate, and other profit.

- For instance, click the “+” sign next to “Profit on debt u/s 7B” to enter the income tax that was paid on a profit from a bank account or a savings certificate. Once the account or certificate number and bank name have been entered, click OK.

- Now click Calculate.

- Next, choose the Computations section. The amount of your taxes will be determined automatically.

- Before completing any returns, you must pay any outstanding balances in front of the Admitted Tax section. (The process is covered in more detail on this blog.)

- Any amount that exceeds the refundable tax can be requested as a refund from FBR.

- Save by clicking.

File Wealth Statement as a Final Step

- Now is the appropriate time to mention your holdings. Following are the procedures for declaring assets.

- If you left your account open after the previous step, log back in. Then, pick the draft, Declaration, Form, and Edit.

- Select Net Assets after choosing the wealth statement. Include all of your belongings as of June 30, the specified year.

- It is necessary to include the annual salary total as well as any tax-free sums recorded in the income tax section.

- If you have any assets, enter the value of any presents you’ve received in the Gift field.

- In the loan box, enter the total of any debts you have taken.

- Include any loans you have taken in the Loan’s total amount.

Inflows & Outflows Section

- As mentioned before, put the complete value of all assets in the Net Assets Current Year field.

- It’s time to add up all of the assets from the previous year.

- Please click the icon to calculate. The unreconciled amount must be zero in order to submit the returns. Make sure all the data is accurate before submitting because it cannot be changed once it has been submitted.

- Review the data, then click “Verification” and enter the 4-digit pin that was provided to you upon registration. Click the Verify Pin button after that.

- Now press the Submit button.

- Now that your tax returns have been submitted, you can file your taxes.

How to Check Filer Status?

To check your filer or non-filer status, type ‘ATL’ (space) 13-digit CNIC number and send it to 9966.

You can also invest in other famous and most in demand housing societies, such as , Blue World City, Rudn Enclave, 7 Wonders City Peshawar, Taj Residencia, Kingdom Valley, New Metro City Gujar Khan, Forest Town Rawalpindi, University Town Rawalpindi, ICHS Town, Park View City Islamabad, Multi Gardens B17 Islamabad and Nova City Islamabad.

Al Sadat Marketing please contact 0331 1110005 or visit https://alsadatmarketing.com/

Few more real estate housing schemes which are trending now a days in Islamabad by including: Faisal Town Phase 2, Prism Town Gujar Khan, New City Paradise, Eighteen Islamabad, 7 Wonders City Islamabad, Capital Smart City, Silver City Islamabad, The Life Residencia, Faisal Town Islamabad, Islamabad Golf City, Islamabad Model Town and Marble Arch Enclave.

Al Sadat Marketing is an emerging Real Estate Agency headquartered in Islamabad, Pakistan. With over 10+ Years of experience, Al Sadat Marketing is providing its services and dealing all trending housing societies projects in different cities of Pakistan. Islamabad Projects, Rawalpindi Projects, Gujar Khan Projects, Burhan Projects, and Peshawar Projects etc.

Book Your Plot Now: +92 331 111 0005