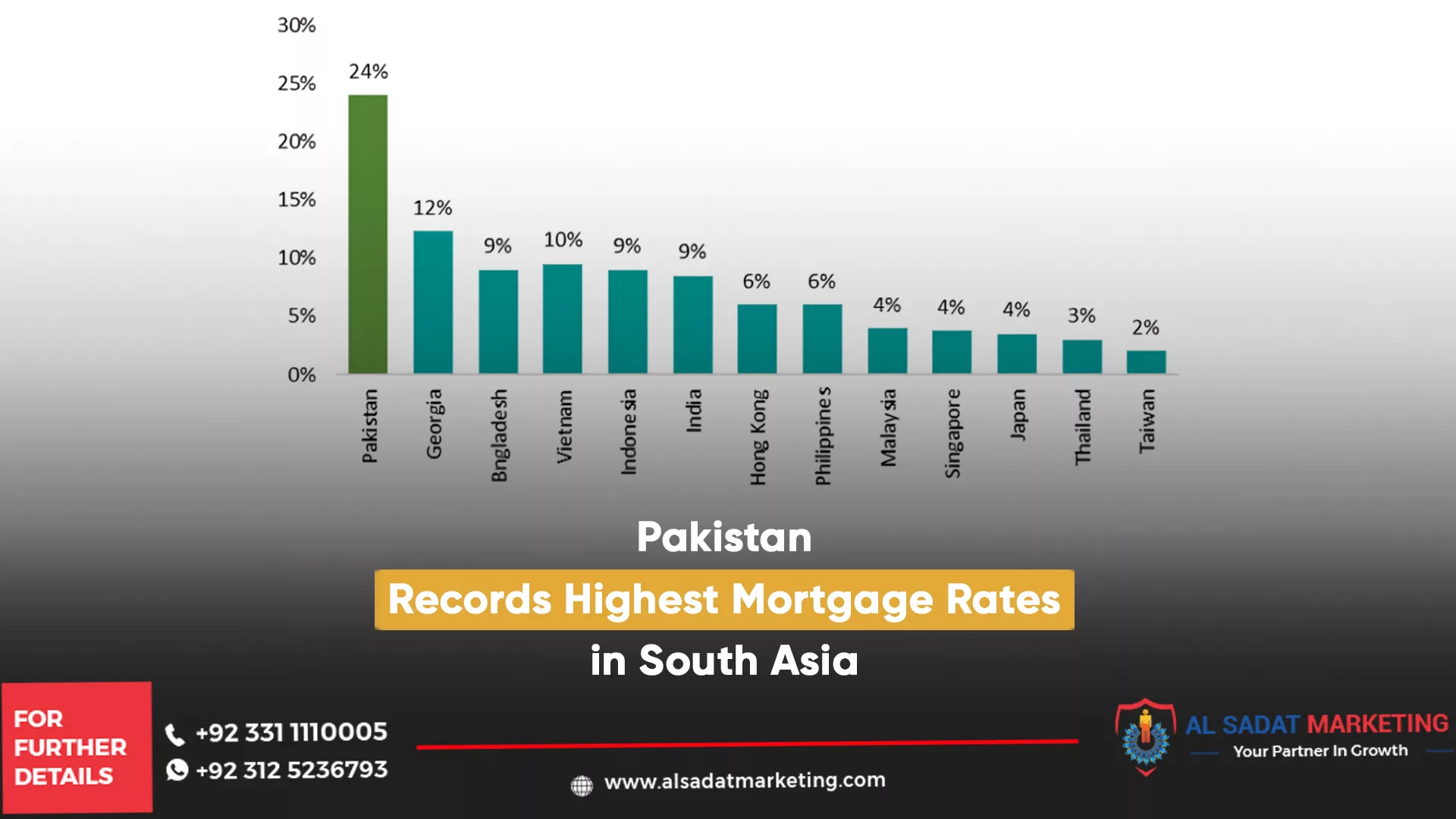

At approximately 24 percent, Pakistan has the highest mortgage rates compared to other South Asian countries. This rate is significantly higher than the 8–9% single-digit mortgage rates that are common in other regional economies like Vietnam, Indonesia, and India.

According to a research study released by House Building Finance Company (HBFC), this scenario stands in stark contrast to more established Asian nations like Singapore, Japan, and Taiwan, where mortgage rates are far lower, ranging between 2 percent and 4 percent.

As per the research, the construction industry possesses around Rs. 200 billion in outstanding loans, of which Rs. 35 billion are short-term or working capital loans and Rs. 165 billion are long-term or fixed investment loans.

Building construction is the largest sector in this industry, with a total value of Rs. 147 billion. Of this, residential construction makes up Rs. 74 billion, and non-residential construction accounts for Rs. 73 billion.

Read More: Lakeshore Residencia Plots Can Now Be Purchased With No Down Payment

High mortgage rates in Pakistan could indicate a number of underlying problems, such as lenders seeing increased risks, a lack of competition in the banking industry, or the effect of inflationary tendencies on the economy.

On the other hand, more stable economies, established credit markets, and possibly more aggressive monetary policies that promote homeownership through more accessible financing options may be the reasons for lower mortgage rates in nations like Taiwan.

The significant difference in mortgage rates highlights the difficulties Pakistan’s home finance sector faces. It emphasizes how crucial it is to implement policy changes that can lower financing costs and improve accessibility for prospective borrowers. These can entail developing banking sector competition, reducing risk factors that result in high loan rates, and putting in place fiscal and monetary policies that encourage more accessible home financing. These actions are vital for increasing the number of people who can become homeowners and promoting expansion in Pakistan’s real estate industry.

Pakistan has to implement focused financial policies to boost the economy and close the housing shortage. Furthermore, regulatory changes are necessary to improve the climate for the expansion of mortgages. Incorporating market incentives may also be a significant factor in improving mortgage accessibility and appeal. These actions are essential for Pakistan’s mortgage industry to grow stronger and more active and to bring it more in line with the developed economies in Asia.

Read More: LDA Destroys Several Illegal Properties in Lahore

Inflationary pressures are causing problems for Pakistan’s real estate industry, which is resulting in a drop in real estate values. This stands in stark contrast to other Asian real estate markets’ resiliency and India’s more positive long-term prospects. Major economic reforms are required to promote market stability and restore investor trust in Pakistan’s real estate sector. In order for Pakistan’s real estate industry to follow the prosperous growth paths seen in other Asian countries, certain reforms are essential.

Mortgage To GDP Ratio in Pakistan

Pakistan’s mortgage-to-GDP ratio has historically exhibited a muted performance, with the ratio usually remaining around 0.5 percent. The data shows a trajectory that starts in the fiscal year 2011 (FY11) at 0.22 percent and ends in FY15 at 0.14 percent. Following this decrease, there is a discernible, if little, increase that peaks at 0.32 percent in FY22 and then slightly declines to 0.28 percent in FY23.

This pattern reveals a relatively underdeveloped mortgage sector that has persisted over time in Pakistan. Nonetheless, the modest increasing trend in recent years points to the start of a rising trajectory. The consistency of the minimal variation and the most recent little growth highlighted a latent potential in the mortgage industry in Pakistan.

To fully realize this potential, deliberate actions are needed, such as targeted economic measures to stimulate the housing market and banking changes to make financing more accessible. Proactive steps like these might spur the mortgage market’s expansion, which is still in its early stages but is beginning to show signs of growth.

Read More: Taj Residencia Awards Possessions Of Multiple Blocks

Pakistan’s mortgage-to-GDP ratio is notably low when compared to other Asian economies. It indicates the country’s nascent mortgage market. This contrasts sharply with nations such as Malaysia and Thailand, where the ratios are substantially higher at 20 and 44 percent, respectively. These numbers, which come from Thailand and Malaysia, indicate more developed markets with greater rates of homeownership and broader credit penetration.

Pakistan’s ratio has been consistently low over the past ten years. It is maintaining around 0.5 percent. It suggests that there is significant space for growth in this market. The market is just starting to develop, as seen by the modest gain seen in recent years. But the striking contrast with its regional counterparts highlights the pressing need for targeted measures.

Going Forward

In 2024, Pakistan’s real estate market is at a turning point. Falling property values and rising mortgage rates signify a sector undergoing change. Property values and investing techniques are subject to adjustments throughout this time.

The downturn in the construction industry, which is a significant employer and generator of the economy, has wider economic ramifications. It may raise unemployment and have an influence on consumer spending and associated businesses.

Pakistan’s real estate market’s future depends on striking a balance between a number of social, political, and economic issues. Resilience and flexibility in the industry will be critical, necessitating strategic planning from stakeholders such as investors, consumers, legislators, and developers. In the end, Pakistan’s real estate market in 2024 will tell the story of the nation’s economy as a whole. Thus, figuring out how to handle its opportunities and problems will be crucial to determining the direction of the economy in that nation.

For more news, visit the Al Sadat Marketing Website.