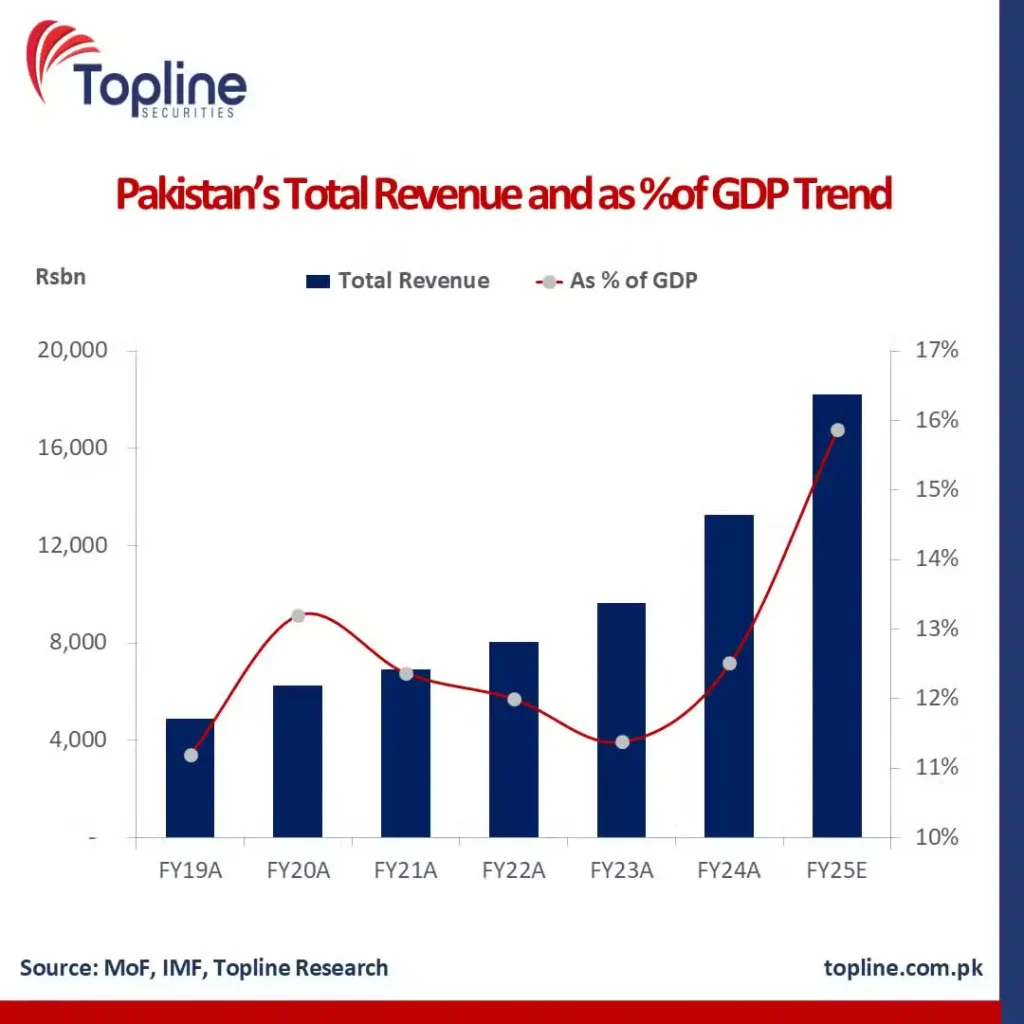

Pakistan’s total government revenue has almost doubled in the last two years, going from Rs. 9.6 trillion to nearly Rs. 18 trillion, according to new data from the International Monetary Fund (IMF). The Finance Ministry says this increase is because of better tax collection, new taxes, and support from the central bank each year. But experts say this growth hides big problems in the country’s tax system.

An investment banker in Islamabad told ProPakistani that most of this increase is just on paper. It happened because tax rates were raised again and again during the yearly budgets. But the number of people and businesses paying taxes has stayed mostly the same.

Many people think this is not real progress but just shifting the tax burden. For example, electricity bills and salary taxes have gone up a lot, but these are sectors already in the tax system. No new taxpayers have been added.

The IMF has praised Pakistan’s tax growth, but some question why the IMF is not asking for real reforms. For example, why is there no full system to track sales and taxes properly? Why don’t top company leaders have to confirm their accounts with the tax department? The Federal Board of Revenue (FBR) tried to fix these problems but faced resistance. Many illegal or hidden transactions still happen.

Also Read: World’s Priciest Purple Mango Lands in Pakistan—And It’s Selling Like Gold!

According to Topline Securities, the government might raise the tax exemption limit for salaries or reduce tax rates slightly, but this depends on IMF approval. They may also adjust minimum wages for inflation and reduce some taxes, but nothing is final yet.

The government also plans to add new taxes, like Rs. 150 billion from snacks and packaged foods, Rs. 600 billion from online content creators, a Rs. 5 per liter increase on petrol and diesel, and Rs. 295 billion more from retailers. This shows the focus is still on adding more taxes rather than fixing the system.

Experts warn that these short-term gains can hurt the chances of real tax reforms later. Many say the FBR is only collecting more from the same taxpayers, not bringing new people into the tax system.

Even though the revenue numbers look good, the next budget might slow down tax growth to reduce pressure on the economy. But without real changes and help from the IMF, the coming year will be tough for workers who pay taxes.