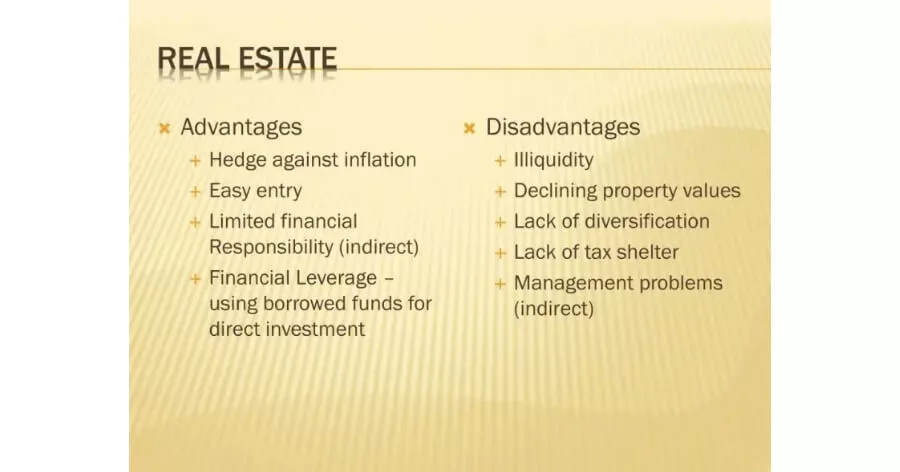

Advantages and Disadvantages of Investing in Real Estate

For many people, investing in real estate can be a tremendously profitable decision. This is especially true if you intend to take advantage of property appreciation by keeping your property for a long time. It’s also possible that things go wrong and you lose your investment in this area.

Investment in every sector has many advantages and disadvantages associated with it. The pros and cons of real estate investment are listed below:

Advantages of Investing in Real Estate

Following are the advantages of investing in real estate:

Real Estate Appreciates Over Time

Real estate that is well picked typically appreciates over time at a rate that is far higher than the annual inflation rate. Yes, there are occasionally market corrections, and buyers of the incorrect kind of property may do so. But there’s always an opportunity to get a good deal on a house, make modifications to raise your equity, and then sell it for more money.

“Buy low and sell high” is the real estate equivalent of the stock market maxim. Additionally, real estate has intrinsic value always. A property is a tangible asset that will always have value generated from both the raw land and the “improvements,” unlike a stock that can go to zero.

Real Estate Has Unique Tax Benefits

Investors can gradually increase their wealth, thanks to real estate’s special tax advantages. The government provides tax benefits to real estate investors, and rental income is not subject to self-employment tax. Depreciation and drastically reduced tax rates on long-term gains are a couple of them.

Additionally, there is a significant probability that your rental property will give you an excess of tax deductions you can utilize against your other income, depending on your income level and status as an investor or real estate professional.

Real Estate Ensures a Steady Cash Flow

Rental revenue, sometimes known as “cash flow,” might come in a consistent stream every month. After all the bills have been paid, this is the remaining cash. After your property is set up, cash flow generates continual, largely passive monthly revenue that frees you up to work on growing your business, spending time with family, or investing in additional properties.

Real Estate Builds Equity

Your tenants are practically buying the property for you when you use leverage wisely. Each month, rental revenue reduces your loan balance and increases your equity. Your tenant pays the rent, increasing your monthly net worth. Imagine it as an automatic savings account that grows without your monthly contributions.

Real Estate Provides a Hedge Against Inflation

One of the few assets that respond to inflation proportionally is real estate. Rents and house values rise in tandem with inflation.

Rental properties that are re-leased year are particularly useful since monthly rents can be increased during inflationary periods, even if real estate, in general, is an excellent inflation hedge.

Real estate is consequently one of the finest strategies to protect an investment portfolio from inflation for this single reason alone.

Real Estate Gives You Control

With real estate investing, you have a lot more control over your total investment success than you have with other asset types. You are unable to influence management choices that affect the value of the stocks you own from a boardroom seat. With real estate investing, a lot of the decision-making is up to you.

Investing in real estate allows you to reduce risks and increase your portfolio at a much faster rate. As a real estate investor, you have power over whether or not you succeed. You can work hard to discover deals when you want to. You can use tactics to make sure the top tenants are drawn to your properties in a competitive rental market. You can enhance rental revenue by strategically making changes.

Disadvantages of Investing in Real Estate

Real estate has many disadvantages too:

Real Estate Requires Maintenance and Management

Property must be renovated, maintained, and managed when an investor buys it. Financing obligations, property taxes, insurance, management fees, and maintenance expenses can quickly mount up, particularly if the property is left unoccupied for a protracted length of time.

Real Estate is Mostly A Long-Term Investment

Always purchase real estate with a longer-term plan in mind. You’re investing in a physical item that won’t be easy to sell for cash if you suddenly need money. Property sales take longer than stock share sales and have greater transaction expenses.

Real Estate Has More Risks

It’s important to comprehend risks and take every precaution to reduce them.

The following are a few of the key hazards associated with real estate investing:

- Purchasing an unsuitable home at the wrong time.

- Liability for accidents that can happen on your premises is increased.

- Being forced to deal with a “professional renter” who can navigate the legal system at your expense.

- Getting overleveraged. Many real estate investors fall victim to this trap. When investing in real estate, you must be able to pay off your loan despite market downturns, tenant issues, vacant properties, unforeseen repairs, maintenance fees, and other costs of doing business.

Real Estate Has Less Liquidity

As with high-frequency stock trading, many investments are very liquid and can be bought and sold for a profit in a split second. Real estate investments, however, are far less liquid because it is difficult to rapidly and readily sell a property without suffering a significant loss in value.

Investors in real estate need to be ready to maintain a property for several years, especially if it will be rented out.

Real Estate Involves Legal Procedures

Real estate investing may be highly confusing because it necessitates a thorough knowledge of the legislation in each jurisdiction where you own property. The investment may even become dangerous because some governments may even implement land ceilings. If the investor is dealing in commercial real estate, the legal issues could become very complicated.

Conclusion

Owning and buying rental homes won’t start you on the path to prosperity right now. If used properly, real estate may be a very effective wealth generation technique. You must develop the ability to identify, assess, and buy solid real estate transactions. Develop a network of reliable contractors, lenders, property managers, and other experts who offer high-quality services at fair pricing.

Al Sadat Marketing has all the details of the real estate sector and the renowned housing projects in major cities of Pakistan on its website. You can also benefit from all the latest news and information through the mobile app and social media platforms of Al Sadat Marketing.

You can also invest in other famous and most in demand housing societies, such as , Blue World City, Rudn Enclave, 7 Wonders City Peshawar, Taj Residencia, Kingdom Valley, New Metro City Gujar Khan, Forest Town Rawalpindi, University Town Rawalpindi, ICHS Town, Park View City Islamabad, Multi Gardens B17 Islamabad and Nova City Islamabad.

Al Sadat Marketing please contact 0331 1110005 or visit https://alsadatmarketing.com/

Few more real estate housing schemes which are trending now a days in Islamabad by including: Faisal Town Phase 2, Prism Town Gujar Khan, New City Paradise, Eighteen Islamabad, 7 Wonders City Islamabad, Capital Smart City, Silver City Islamabad, The Life Residencia, Faisal Town Islamabad, Islamabad Golf City, Islamabad Model Town and Marble Arch Enclave.

Al Sadat Marketing is an emerging Real Estate Agency headquartered in Islamabad, Pakistan. With over 10+ Years of experience, Al Sadat Marketing is providing its services and dealing all trending housing societies projects in different cities of Pakistan. Islamabad Projects, Rawalpindi Projects, Gujar Khan Projects, Burhan Projects, and Peshawar Projects etc.

Book Your Plot Now: +92 331 111 0005