How to Open A Bank Account with An SMS?

Opening a bank account can be a big trouble. Banks have different requirements for opening accounts, and some tend to ask more questions than others. It is considerably more challenging if you have a job because you require additional documentation to verify your employment.

You may now easily open a bank account from the comfort of your home thanks to a new service from the State Bank of Pakistan (SBP). You can still accomplish this even if your internet connection is down. You can now open a bank account by sending an SMS to *2262# through SBP’s new Asaan Mobile Account Service.

You can register, select a bank, provide your CNIC details, and receive a PIN for your account by sending an SMS to the aforementioned code.

This shows that any bank, not just the State Bank of Pakistan, can use the option to open an account.

Women and transgender citizens, particularly those without mobile data, should have easier access to the financial system. Right now, you can open a bank account without going to a bank by messaging *2262#. You only need your CNIC. It is an attempt to make banking accessible for everyone and not just a few. The government officials clarified, however, that women receive special consideration because they frequently have trouble opening bank accounts.

How to Open ‘Asaan Mobile Account’ Without Internet?

The Asaan Mobile Account (AMA) scheme was formally introduced on December 13, 2021, in a ceremony held at the headquarters of the State Bank of Pakistan (SBP), Karachi, with the goal of bringing the unbanked people into formal banking services.

At the launch occasion were Mr. Muhammad Naveed, Member (Finance) PTA, and Governor SBP, Dr. Reza Baqir. Maj. Gen. Amir Azeem Bajwa (R), Chairman PTA, virtually addressed the occasion and stated that despite the National Financial Inclusion Strategy (NFIS) rollout, the Pakistani government is still dedicated to enhancing the country’s digital payment and financial inclusion ecosystems. PTA and SBP collaborated to create the first ever regulatory framework for mobile banking interoperability in 2016 due to PTA’s role as one of the primary NFIS implementers. Additionally, PTA and SBP collaborated with pertinent parties to support remote digital on-boarding.

The initiative will be crucial in empowering women economically and enhancing their socioeconomic standing in the nation, according to Chairman PTA. He commended the SBP, commercial banks, cellular mobile operators (CMOs), and VRG for launching the AMA Scheme effectively. According to him, the AMA Scheme will have a tremendous impact on Pakistan’s large unbanked population because it will make ubiquity and accessibility of financial services available to a market of over 187 million biometrically validated SIMs and users.

The AMA scheme was created with the goal of offering a simple, quick, cost-effective, and completely interoperable channel for obtaining financial services among operators and financial institutions.

In Pakistan, SBP has unveiled a brand-new program called “Assan Mobile Account” that enables users to open branchless bank accounts. The scheme, which was introduced on Monday, enables Pakistani nationals to open an account at any bank using their mobile device.

According to SBP, the program is a small part of a national strategy for financial inclusion that focuses on making it easier to open remote accounts in branchless banking. The unique feature of the new program is that even untrained mobile users can open a bank account on their own without using an internet connection.

Requirement for Opening The Account

Any Pakistani citizen who possesses a national identity card is eligible to open and manage a “Asaan Mobile Account,” according to the SBP. In addition, in order to open an account, you must also have a mobile phone SIM that is registered in your name. And a typical mobile phone user may complete the process with ease.

How to Open and Use This Account

You must dial 2262 from your mobile device in order to open the account. A star (*) must be used to begin this code, followed by a hash (#) button.

Asaan Mobile Account Scheme initially includes 13 banks. To open an account, you can select any bank of your choosing. You can go to any branchless banking agent and make a deposit after opening the account by using your mobile device to validate the National Identity Card number.

He can use the funds in any way after they are deposited by phoning the SSD code from his mobile device.

The process for creating Assan mobile accounts has been developed in partnership with the State Bank of Pakistan, the Pakistan Telecommunication Authority (PTA), the National Database and Registration Authority, 13 sources for branchless banking, cellular phone operators, and the Virtual Remittance Gateway.

Who Benefits from Internet Banking?

The ability to send or receive small sums of money using branchless banking makes this account useful for low-income communities without internet access. Additionally, this is a very beneficial project for women in society.

SBP Governor Raza Baqir stated that 187 million people in Pakistan have mobile phone accounts that have undergone biometric verification while speaking at the scheme’s launch. Among the 187 million mobile phone users, 81 million do not have access to the Internet.

According to him, such clients are the primary aim of the Asaan Mobile Account Scheme, which is a component of the national strategy for financial inclusion. According to the SBP, this program will open up the banking industry to 50 million Pakistanis.

Banks Integrated on Asaan Mobile Account Scheme

- Bank Alfalah

- EasyPaisa

- JazzCash

- U-Bank

- HBL

- Meezan Bank

- Finca Bank

- UBL

- MCB

- Askari Bank

- JS Bank

- First Microfinance

- Allied Bank

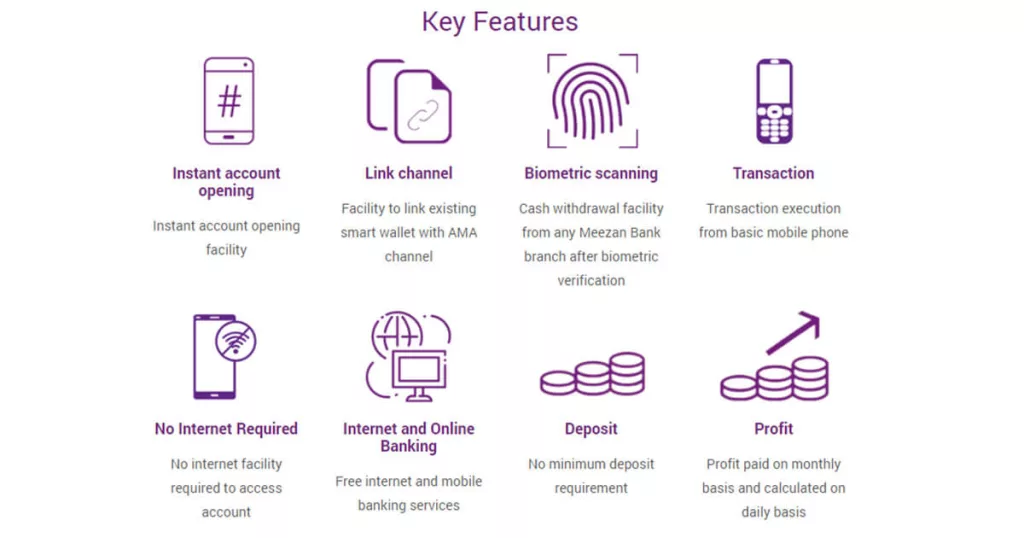

Features of Asaan Mobile Account

Users of Asaan Mobile Account can take advantage of the following features:

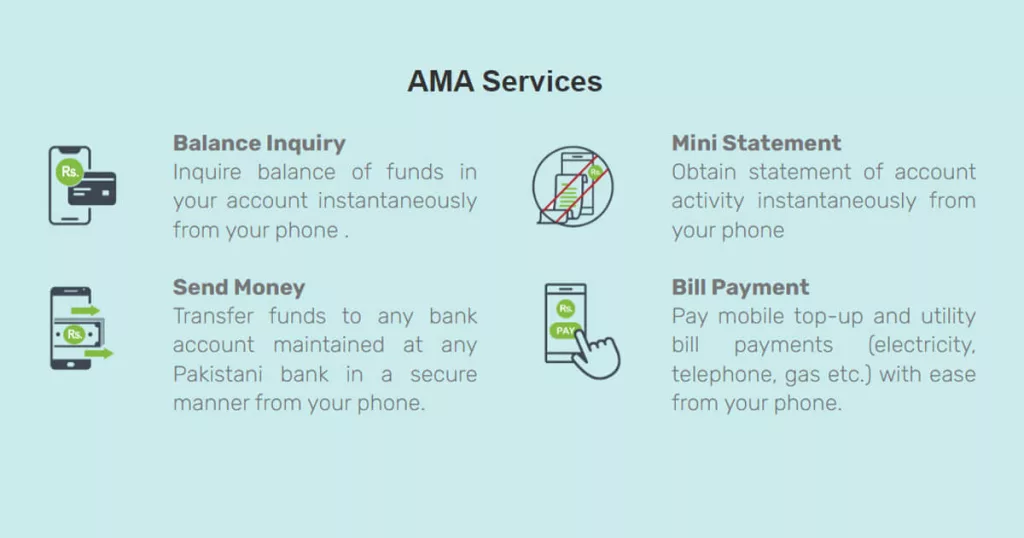

Transfers: You may now transfer money to any bank account in Pakistan with ease using your Asaan Mobile Account.

Payments: You can make the following types of payments using your Asaan Mobile

Account:

- Paid utility bills

- Top-up/Mobile Balance Purchase

- Payment for Postpaid Mobile Bills

Cash Deposit and Withdrawal Services: Asaan Mobile Account members have the option to effortlessly deposit and withdraw cash from neighboring ABL banks and Easypaisa agents. For the deposit and withdrawal services, you must be a biometrically confirmed user (Details available in User Guide)

Account Statement: By phoning *2262# from a mobile phone and choosing the view statement option, users can check their account statements.

Account Linking: Attach your current myABL Wallet account to your Asaan Mobile account.

Upgrade to Wallet: By registering on the myABL Wallet app, Asaan Mobile Account customers can also upgrade their accounts to the Wallet app.

You can also invest in other famous and most in demand housing societies, such as , Blue World City, Rudn Enclave, 7 Wonders City Peshawar, Taj Residencia, Kingdom Valley, New Metro City Gujar Khan, Forest Town Rawalpindi, University Town Rawalpindi, ICHS Town, Park View City Islamabad, Multi Gardens B17 Islamabad and Nova City Islamabad.

Al Sadat Marketing please contact 0331 1110005 or visit https://alsadatmarketing.com/

Few more real estate housing schemes which are trending now a days in Islamabad by including: Faisal Town Phase 2, Prism Town Gujar Khan, New City Paradise, Eighteen Islamabad, 7 Wonders City Islamabad, Capital Smart City, Silver City Islamabad, The Life Residencia, Faisal Town Islamabad, Islamabad Golf City, Islamabad Model Town and Marble Arch Enclave.

Al Sadat Marketing is an emerging Real Estate Agency headquartered in Islamabad, Pakistan. With over 10+ Years of experience, Al Sadat Marketing is providing its services and dealing all trending housing societies projects in different cities of Pakistan. Islamabad Projects, Rawalpindi Projects, Gujar Khan Projects, Burhan Projects, and Peshawar Projects etc.

Book Your Plot Now: +92 331 111 0005