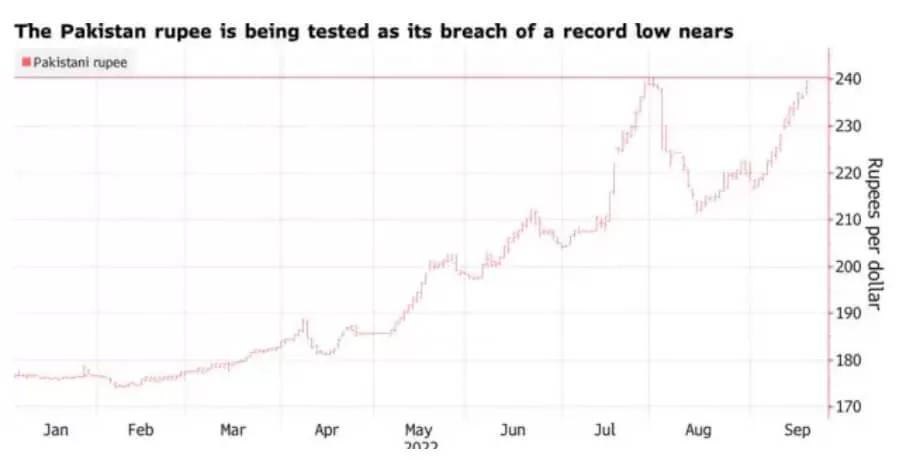

Rupee to Fall Against Dollar for 8th Consecutive Session

Bigwigs in Pakistan have been unable to develop a successful plan to halt the free decline of the local currency since policy discussions have so far centered on improving border administration and trade-related payments.

According to official records and background conversations with those involved in the process, Prime Minister (PM) Shehbaz Sharif has convened a committee headed by Finance Minister Miftah Ismail to “stabilize foreign currency markets” and has also recently had a number of meetings.

The authorities have been guided by the intelligence services, but they have been unable to stop the currency’s free collapse. The rupee continued its downward trajectory on Monday, closing at Rs237.91 to the dollar in interbank trading. The open market rate, which fluctuated between Rs244 and Rs246 to a dollar, was significantly higher.

People are being forced to pay the highest rates in the history of the nation due to the persistent depreciation of the local currency, which has also undermined the benefit of the decline in crude oil prices.

The committee was established by PM Shehbaz last Monday to examine the deteriorating monetary situation. The committee met the next day to complete its interim advice to the PM.

But the majority of the decisions made in these meetings focused on bolstering the current operating systems. The Federal Board of Revenue (FBR) will also improve its system for real-time reporting of currency flows and issue a new notification requiring international travelers to register their foreign cash, it was also determined at the meeting.

Travelers flying internationally will only need to report their currency if it is $5,000 or more, while passengers flying domestically will need to declare their currency if they have $10,000 or more. The notification, which is anticipated soon, will put an end to the uncertainty for travelers from other countries.

Regardless of the amount, air travelers must currently file a foreign currency declaration. According to the sources, several of the new policies the administration has begun implementing could only slightly help the situation. The severity of the problem, which calls for tough enforcement measures against hoarders, including bankers, and precise estimates of currency demand and supply, was still not completely understood by the administration.

The PM established a committee on foreign exchange to stabilize the foreign exchange markets. Along with the Minister of Finance serving as its chairman, the group’s other members included the Director General of the Intelligence Bureau, the Director General of the ISI, and officials from the MI and SBP. The adviser to the PM on Establishment, MNA Ali Pervez Malik, was also a member.

The committee’s mandate includes proposing solutions to market flaws, unregulated illicit activities including hawala and hundi trade, and foreign currency smuggling. These include efforts to stop manipulation in foreign currency markets.

The committee was also requested to suggest a plan of action to discourage the hoarding of foreign currency for speculative purposes and to stop the fraudulent use of debit and credit cards to send money abroad.

The group considered these issues, according to the sources, and last week it gave the PM its recommendations.

These suggestions have led to the decision that the FBR and the SBP will take action to prevent importers from overbilling, which causes a greater outflow of foreign currency than is necessary. Additionally, the FBR and SBP will take steps to ensure enhanced border control, such as promptly depositing export revenues from Afghanistan.

As a result, the FBR has been instructed to streamline its currency declaration process, which will both ease the burdens placed on commuters and give real-time data regarding the internal and outbound flow of currency through airports.

Additionally, it has been decided that the FBR will release an application that will make it simple for passengers leaving the country to submit advance declarations.

Some attendees of the discussion, meanwhile, felt that the government should take more decisive action to solve the issue and that these modest moves wouldn’t help to calm the markets’ concerns. They said that despite bankers’ massive profits from betting on the rupee, the government and central bank were unwilling to take action against them.

The government also needed to alter its goals for the exports, imports, and current account deficits in order to make the statistics more realistic so that it could plan the inflows and outflows properly.

US Dollar Rate in Pakistan -21 September, 2022

USD to PKR Exchange rates constantly change based on global supply and demand. Understanding the exchange rate for your currency on this page may help you convert money at the most advantageous rate. USD/PKR exchange rate for 21st September is 1 dollar=240.30 rupees.

Conclusion

Due to the failure of the Middle East to deliver billions of dollars in promised aid to support the struggling South Asian country’s economy, Pakistan’s currency is on the verge of hitting a historic low.

The rupee is only about 0.4% away from it’s all-time low of 240.375 to the dollar, which it hit earlier this year. With a decline of more than 8%, the euro is among the worst performers globally in September.

After inflation climbed to its highest level in nearly five decades, a declining currency could make Pakistan’s price pressures worse. The country is also dealing with the fallout from a string of catastrophic floods and requires more funding in addition to the IMF’s $1.1 billion loan to avoid defaulting.

As a way to increase its foreign exchange reserves and relieve pressure on its currency, Pakistan also anticipates receiving $4 billion in funding from the World Bank, Asian Development Bank, and Asian Infrastructure Investment Bank.

In addition to receiving financing from outside to increase reserves, Pakistan has attempted to curb currency speculation. According to its finance minister Miftah Ismail, it is looking into eight banks for foreign exchange speculating and selling dollars at a rate that is 5% to 10% more than the going rate.

Experts claim that a number of causes, such as a rise in import costs as a result of flooding, smuggling, and friendly nations breaking their commitment to lend Pakistan money once it had received a loan tranche from the International Monetary Fund, are to blame for the rupee’s slide.

You can also invest in other famous and most in demand housing societies, such as , Blue World City, Rudn Enclave, 7 Wonders City Peshawar, Taj Residencia, Kingdom Valley, New Metro City Gujar Khan, Forest Town Rawalpindi, University Town Rawalpindi, ICHS Town, Park View City Islamabad, Multi Gardens B17 Islamabad and Nova City Islamabad.

Al Sadat Marketing please contact 0331 1110005 or visit https://alsadatmarketing.com/

Few more real estate housing schemes which are trending now a days in Islamabad by including: Faisal Town Phase 2, Prism Town Gujar Khan, New City Paradise, Eighteen Islamabad, 7 Wonders City Islamabad, Capital Smart City, Silver City Islamabad, The Life Residencia, Faisal Town Islamabad, Islamabad Golf City, Islamabad Model Town and Marble Arch Enclave.

Al Sadat Marketing is an emerging Real Estate Agency headquartered in Islamabad, Pakistan. With over 10+ Years of experience, Al Sadat Marketing is providing its services and dealing all trending housing societies projects in different cities of Pakistan. Islamabad Projects, Rawalpindi Projects, Gujar Khan Projects, Burhan Projects, and Peshawar Projects etc.

Book Your Plot Now: +92 331 111 0005