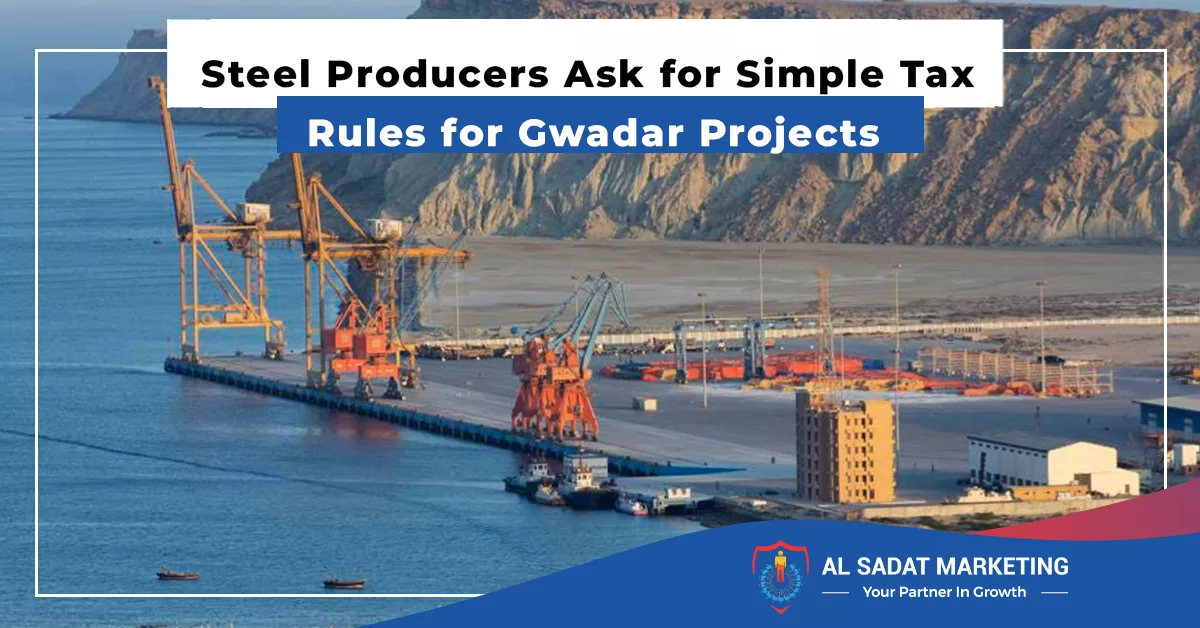

Steel Producers Ask for Simple Tax Rules for Gwadar Projects

According to our sources in Karachi, steel makers petitioned the Federal Board of Revenue (FBR) on Tuesday to clarify sales tax restrictions that have barred them from supplying steel to tax-exempt huge projects in Gwadar, such as the free zone and airport.

Syed Wajid Bukhari, Secretary-General of the Pakistan Association of Large Steel Producers (PALSP), indicated that producers may benefit from this incentive in the absence of a formal method for getting sales tax exemption.

Read: Car Prices Are Going to Rise Again in Pakistan

He noted that the association has expressed concerns to the FBR over the Sales Tax Rules 2006 and Chapter IV – Apportionment of Input Sales Tax, sub-rules 1 and 2.

Chapter IV, Subrule 1 of the Sales Tax Rules prohibits the adjustment of sales tax paid at the input stage against any other supply.

In addition, subrule 2 of Chapter IV says that the manufacturer may not change input sales to the extent of the exempted sales tax amount under this regulation for any other supplier, which is both unlawful and unreasonable.

He noted in a statement that the group had voiced reservations about the relevant rule, which oddly seeks to punish the manufacturer while only benefiting the buyers. Under this law, the amount of sales tax input equal to the amount exempted is effectively rejected. Therefore, the producers have no alternative but to seek a refund of the sales tax they have already paid.

Mr. Bukhari noted that the government has exempted domestic suppliers of world-class materials to SEZs, CPEC projects in Gwadar, export processing zones (EPZs), and other significant government projects in order to create more jobs and attract investment for the expansion of local industry.

Read: Top 10 Challenges in Real Estate Industry of Pakistan

However, the reality is somewhat different. He bemoaned the fact that the contractors of the Gwadar Free Zones rely on imported steel instead of sourcing it from local businesses.

He requested that the government alter the legislation and take prompt action to let the local steel industry to provide steel to significant tax-exempt projects, so ensuring that the domestic steel industry will profit from these megaprojects.

For more information and details, visit our website Al Sadat Marketing.

You can also invest in other famous and most in demand housing societies, such as , Blue World City, Rudn Enclave, 7 Wonders City Peshawar, Taj Residencia, Kingdom Valley, New Metro City Gujar Khan, Forest Town Rawalpindi, University Town Rawalpindi, ICHS Town, Park View City Islamabad, Multi Gardens B17 Islamabad and Nova City Islamabad.

Al Sadat Marketing please contact 0331 1110005 or visit https://alsadatmarketing.com/

Few more real estate housing schemes which are trending now a days in Islamabad by including: Faisal Town Phase 2, Prism Town Gujar Khan, New City Paradise, Eighteen Islamabad, 7 Wonders City Islamabad, Capital Smart City, Silver City Islamabad, The Life Residencia, Faisal Town Islamabad, Islamabad Golf City, Islamabad Model Town and Marble Arch Enclave.

Al Sadat Marketing is an emerging Real Estate Agency headquartered in Islamabad, Pakistan. With over 10+ Years of experience, Al Sadat Marketing is providing its services and dealing all trending housing societies projects in different cities of Pakistan. Islamabad Projects, Rawalpindi Projects, Gujar Khan Projects, Burhan Projects, and Peshawar Projects etc.

Book Your Plot Now: +92 331 111 0005