The Effects of Currency Depreciation on Real Estate

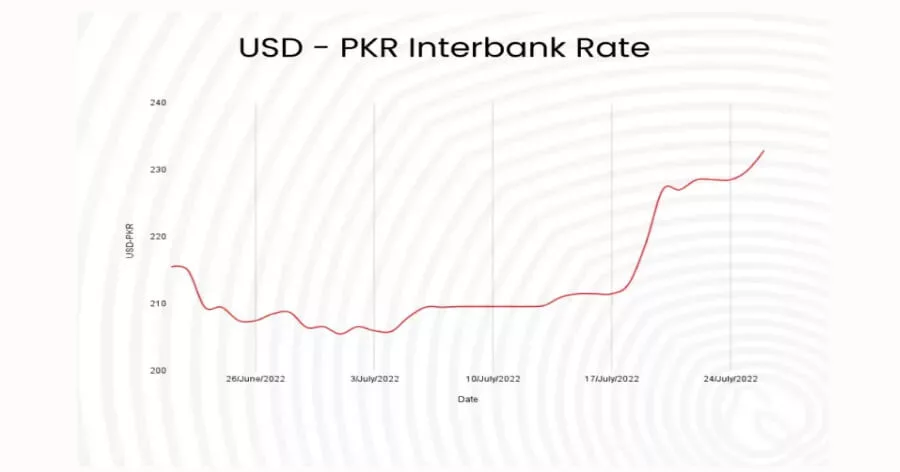

The Pakistani rupee just lost 1.3% of its value versus the US Dollar, which increased to 235 PKR on July 28, 2022. The political unrest in Pakistan and the strengthening of the dollar against developed and emerging currency markets are both factors contributing to the fall of the rupee in the interbank and open market.

Before this increase in the dollar rate, the State Bank of Pakistan raised the policy rate by 125 basis points from 13.75% to 15% to combat inflation. The economy has suffered as a result of these two problems. The business community has also expressed its worries about depreciating currency because it will make conducting business more expensive. Real estate is not an exception to how these changes are affecting other industries.

Impact of Rupee Depreciation on Real Estate

In the upcoming days, as the price of labour, raw materials, and transportation rises, the full effects of this currency depreciation on real estate will become clear. According to the figures from the previous year, the sum of total imports was around $56 billion.

Around 27% of the entire import bill was made up of mineral fuels and oil. Additionally, the nation imported $4.59 billion worth of iron and steel as well as various sorts of machinery and the total amount was $5.88 billion. These numbers indicate that the cost of construction will probably rise as well.

For instance, steel and iron are utilized in buildings, and as a result of the dollar’s rise, both will become more expensive, driving up the price of construction soon.

Fuel prices will rise as a result of the rupee’s depreciation, raising the price of transportation.

Golden Opportunity for Overseas Investors

Foreign investors, particularly those in real estate, will benefit from the dollar’s rise to Rs. 235 because all modern real estate properties will now be more affordable. So, it is the ideal time for them to make a real estate investment.

Finding the ideal property is the main challenge for international or overseas real estate investors. Furthermore, it is challenging for them to invest in Pakistan’s real estate due to the paperwork and regulatory requirements of every transaction.

The current value of the rupee makes real estate a profitable investment choice, provided that all these obstacles are removed and the procedure is made simpler for international or overseas investors.

Impact of Rupee Depreciation on Local Investors

For people who reside abroad and international investors, the decline in the value of the PKR is advantageous. However, the locals, particularly first-time homebuyers and investors, suffer from these currency changes. It will become harder for local buyers to buy a house when the purchasing power declines.

Due to the greater returns and long-term financial security that hard assets like real estate offer, the majority of investors do so in an inflationary environment. If not, the value of the money in the bank account would decrease as the rupee continues to lose value.

Higher interest rates are a widespread problem that makes house loans pricey for the average person. They will be compelled to hunt for a rental house as a result of all these considerations. Landlords can raise the rent in response to the rising demand for rental properties because prospective renters are willing to pay more in an inflationary climate.

Impact On Developers

1. The devaluation of the rupee has an indirect impact on the cost of goods and services such as steel, consulting, the outsourcing of architects or engineers, cement, labour costs, transportation, etc. This increases the project’s cost and time index, which in turn becomes the primary cause of project delays.

2. A few pieces of technology and equipment are not readily available in Pakistan, so developers import them. In this case, rupee devaluation has an adverse financial impact.

3. It has an impact on industry promotions and new hiring. In this scenario, there is less demand for real estate and more wait-and-see behaviour, which pushes the market towards saturation.

The Demand for Real Estate Decreases

The one significant factor causing inflation in Pakistan is devaluation. Hyperinflation is a term that can be used to describe extremely high inflation. This hyperinflation is to blame for the rise in real estate costs in Pakistan. The level of employment is also at its lowest point, which is hurting people’s ability to spend money.

Due to people’s inability to acquire these Pakistani houses at such high prices given their poor earnings, the demand for real estate has declined in these conditions. A middle-class person can only aspire to invest in Pakistan’s upscale neighbourhoods because of the exorbitant pricing in places like Islamabad, Karachi, and Lahore.

Due to this circumstance, Pakistani real estate enterprises are currently experiencing difficulties. Property owners and real estate agencies are having little luck finding a buyer in the market.

New Investors Must Be Cautious

There are a few tips for new investors that they must keep in mind before investing in real estate in the current economic situation:

- Investors should purchase a home with strong rental potential since it can generate a consistent stream of income.

- Residential property is a better investment than a commercial one when a currency is depreciating since the risk is significantly smaller.

- It is preferable to invest in a house or apartment that has already been built because the price of properties that are still being built can change as a result of rupee depreciation.

While a weakening rupee may be advantageous for overseas buyers, new investors should exercise caution if they intend to enter the market for home buyers. It’s possible that home prices are overpriced.

The current economic circumstances will have an impact on all industries. However, in the coming days, the stakeholders will search for solutions to maintain the current state of affairs until this returns to normalcy. A coin always has two sides, and while a weak domestic currency is bad for the economy overall, it may also be a fantastic investment opportunity for both people and organizations.

Conclusion

Choosing an investment during a recession is a difficult decision to make, but each person should consider diversifying their sources of income. One such choice is investing in real estate, which may be quite helpful in situations where the value of your currency is declining quickly.

The idea of a depreciating currency is not new, and individuals have been prepared for situations like this by investing in real estate. However, there are still plenty of chances in the real estate market right now, so it’s never too late to invest. Investing in real estate can protect you from potential financial difficulties.

The repercussions of currency devaluation on Pakistani real estate are now readily apparent. To promote stability, the Pakistani government and state bank should control their actions. in rupees of Pakistan. To prevent inflation and devaluation in Pakistan, they should implement stringent policies and a proactive monitoring strategy.

You can also invest in other famous and most in demand housing societies, such as , Blue World City, Rudn Enclave, 7 Wonders City Peshawar, Taj Residencia, Kingdom Valley, New Metro City Gujar Khan, Forest Town Rawalpindi, University Town Rawalpindi, ICHS Town, Park View City Islamabad, Multi Gardens B17 Islamabad and Nova City Islamabad.

Al Sadat Marketing please contact 0331 1110005 or visit https://alsadatmarketing.com/

Few more real estate housing schemes which are trending now a days in Islamabad by including: Faisal Town Phase 2, Prism Town Gujar Khan, New City Paradise, Eighteen Islamabad, 7 Wonders City Islamabad, Capital Smart City, Silver City Islamabad, The Life Residencia, Faisal Town Islamabad, Islamabad Golf City, Islamabad Model Town and Marble Arch Enclave.

Al Sadat Marketing is an emerging Real Estate Agency headquartered in Islamabad, Pakistan. With over 10+ Years of experience, Al Sadat Marketing is providing its services and dealing all trending housing societies projects in different cities of Pakistan. Islamabad Projects, Rawalpindi Projects, Gujar Khan Projects, Burhan Projects, and Peshawar Projects etc.

Book Your Plot Now: +92 331 111 0005