Why Savings and Investments Are Becoming Important in 2023?

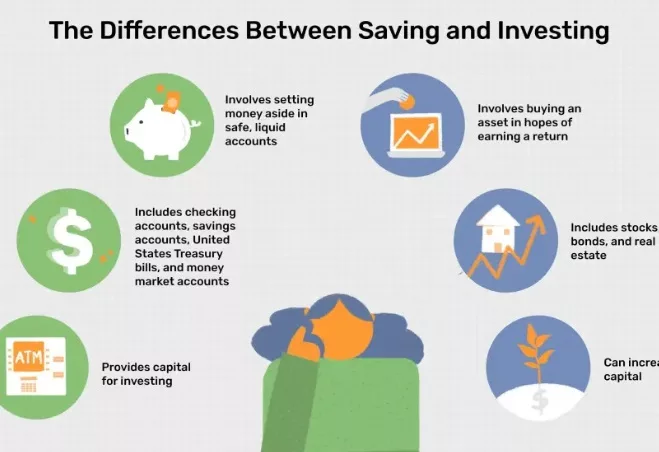

For laying a strong financial foundation, saving and investing are both important ideas, but they are not the same thing. Both can help you build a more secure financial future, but consumers need to understand the distinctions between the two and when each is preferable.

The degree of risk taken is the main distinction between investing and saving. You normally get a smaller return from saving, but there is almost no danger. Contrarily, the investment gives you the chance to make a bigger return but comes with the danger of losing money.

Saving

Saving is the act of setting money aside in bank accounts for a future expense or necessity. Saving money is very low-risk and highly liquid, and it is there when you need it for purchases or emergencies quite quickly.

Investing

When you invest your money, you take on additional risk in exchange for high returns on assets that increase in value over time. Investing is often illiquid and volatile. Selling your possessions at a profit, or realizing capital gains, is how you generate returns.

Similarities

Both saving and investing have the same objective, which is to help you acquire money for use in the future, so they are similar in many respects. In essence, financial instruments that hold savings and investments have a monetary worth. To accumulate funds, both need specialized accounts with a financial institution. And both require financial planning, which entails examining your financial objectives and goals.

Differences

Savings differ from investments in that money is frequently put into a bank savings account or a fixed deposit. On the other hand, investing involves purchasing assets with the potential to appreciate in value over time, such as stocks, bonds, mutual funds, real estate, gold, and so on.

The first and most significant distinction between investing and saving is risk. When you deposit money into a savings account, you are saving. Although there is little chance of losing money, there are also little gains. When you save money, you can typically access it when you need it. When you invest, there is a chance for bigger long-term gains or rewards, but there is also a chance for loss.

When you invest, you run a higher risk of losing more money than you could gain. To determine which strategy saving or investing is ideal for each of your goals, it’s critical to assess your objectives.

The Pros and Cons of Savings

Pros:

- You can easily access your money in a savings account. Due to the requirement that you give advance notice of any intended cash withdrawals, a notice deposit guards your savings against irrational withdrawals. A fixed deposit is a form of savings account that allows you to pick the investment time, offers a fixed interest rate for the whole investment period, and also guards against arbitrary withdrawals.

- Because they are steady and don’t change in parallel with the stock market, these kinds of savings accounts carry a low risk. Although you might not experience the same levels of interest, you can rest easy knowing that your capital quantity is secure and how much interest it will generate.

Cons:

- Interest rates on savings accounts are lower than those on high-risk investments.

- It takes a lot of commitment and discipline to save. Easy access to your money could cause you to blow through your savings on impulsive purchases. You do not have easy access to your money while investing for a longer period of time.

The Pros and Cons of Investment

Pros:

- Over longer time periods, investment accounts often provide the potential for higher returns than savings accounts.

- Based on your investment criteria and level of risk tolerance, an investment account enables you to choose how to distribute the assets in the account.

Cons:

- A market or economic crisis might easily impact the value of your investment.

- There is a chance of suffering a financial loss.

- Depending on the fund management, a minimum lump sum amount deposit or regular debit order is necessary for an investing account.

- You must consider each fund in light of the timeframe of your investment, your risk tolerance, and the investment’s goals because a fund’s previous success does not guarantee its future performance.

Why is Investing So Important?

You can achieve your goals and safeguard your financial future through investing. Here are a few advantages of investing that show their significance:

Earn Higher Returns

One can get better profits from investing than from saving. In favorable market conditions, a variety of investment vehicles can provide investors with substantial returns. One can make their money work for them by investing.

Meet Financial Goals

Investments are a way to build wealth. A goal-driven approach to investing will encourage investors to make regular investments and help in accomplishing the objective.

Beat Inflation

Inflation might wipe out one’s savings, which also lowers their purchasing power. In other words, a year from now, a rupee will be worth less than it does today. Inflation is the main cause of this. One must make sure their money rises if they want to combat rising expenditures. Only investment can do this.

Financial Discipline

Systematic investing is one of the various investment options available on the market. By making frequent investments, one not only achieves their objective but also establishes an investment practice. By consistently investing, one can develop sound financial discipline. Additionally, it will assist them in controlling their spending.

Conclusion

The greatest choice actually relies on your ambitions and present financial situation. As a general guideline, save if you’ll need money soon or in an emergency. Invest if you won’t need the money for three years or more.

You can also invest in other famous and most in demand housing societies, such as , Blue World City, Rudn Enclave, 7 Wonders City Peshawar, Taj Residencia, Kingdom Valley, New Metro City Gujar Khan, Forest Town Rawalpindi, University Town Rawalpindi, ICHS Town, Park View City Islamabad, Multi Gardens B17 Islamabad and Nova City Islamabad.

Al Sadat Marketing please contact 0331 1110005 or visit https://alsadatmarketing.com/

Few more real estate housing schemes which are trending now a days in Islamabad by including: Faisal Town Phase 2, Prism Town Gujar Khan, New City Paradise, Eighteen Islamabad, 7 Wonders City Islamabad, Capital Smart City, Silver City Islamabad, The Life Residencia, Faisal Town Islamabad, Islamabad Golf City, Islamabad Model Town and Marble Arch Enclave.

Al Sadat Marketing is an emerging Real Estate Agency headquartered in Islamabad, Pakistan. With over 10+ Years of experience, Al Sadat Marketing is providing its services and dealing all trending housing societies projects in different cities of Pakistan. Islamabad Projects, Rawalpindi Projects, Gujar Khan Projects, Burhan Projects, and Peshawar Projects etc.

Book Your Plot Now: +92 331 111 0005