How to Estimate Your Rental Property Expenses in 2023?

One of the greatest real estate investing options is renting out a property. Investments in rental properties offer significant returns year after year, regardless of the market, as well as tax advantages and passive income.

Unlike other sorts of investments, rental property investment can protect investors and their capital while generating sizable income for years to come with little to no work. But what about the up-front expenses related to buying a rental property? Better still, what is the cost associated with your investment in long-term rental properties?

Read More: Tips for Staying Productive and Organized at Work in 2022

Renting out real estate can be quite profitable, but investors need to be aware of all the associated costs. A rental property will require additional charges through its operating expenses in addition to acquisition costs.

As a result, investors must comprehend the “whole picture” of rental properties, which includes both the present and potential future expenditures.

Additional Costs of A Rental Property

Rental property investment will involve a variety of charges in addition to the initial outlay. Investors must stay aware of all potential costs associated with their investments. By doing this, you can create a budget with precise estimations.

Maintenance

The price of monthly maintenance is not governed by any strict rules. Investors must keep enough money on hand to cover the monthly costs associated with the rental property, even though maintenance fees vary from property to property. This covers the maintenance of the property’s interior common areas as well as the exterior, such as exterior curb appeal. These expenses may also cover occasional repairs to the building’s plumbing, or roofing.

Home Inspection

Before making an investment in a rental property, a house inspection is necessary. Any hidden damage that the seller might not be aware of will be found during a property inspection. Even while this cost might seem unimportant, as a rental property investor, it will end up saving you money in the long run.

Read More: Naya Pakistan Housing Scheme – Kingdom Valley Islamabad

It is simple for a home inspector to spot undiscovered damage, but challenging for an inexperienced eye, such as roof damage, mould, or mechanical failures. You will have to make these repairs later if these issues are not resolved now, which will actually reduce your profits.

Property Upgrades or Improvements

In addition to routine maintenance, you might choose to update your investment to attract more renters. This could involve repainting your rental property, and installing new hardware like windows or fences.

Depending on the condition of the property, the cost of these rental property charges will change. For instance, it will cost you more to buy a distressed property and make the necessary improvements to make it rentable than it would to buy a modern and well-maintained property.

Property Taxes

Property taxes are one of the expenses related to rental property investment. The district where the property is located imposes this fee, which is often depending on the jurisdiction of the property. The local authorities will typically decide this rate after determining the current fair market value of the area.

Read More: New Metro City Gujar Khan Balloting Date Extended

However, you may be able to deduct the property tax from your income on your tax return. Investors wishing to obtain a precise assessment of their existing property tax obligations should contact their district authorities.

Utility Expenses

The tenant is responsible for covering the cost of all necessary utilities, including electricity, water, and gas. However, the owners are responsible for paying the utilities, such as sewer, deep cleaning, and inspection.

The homeowners must put aside a high price for these utilities. Therefore, including these utility expenditures in the rental property expense calculation is required.

Broker Charges

The broker fee is another thing that must be taken into account when estimating rental property costs. We are all aware of how challenging it may be to find a tenant. However, the task can be made simpler and more effective with the help of a knowledgeable or experienced broker.

Read More: CDA’s Intensive Operation Against Illegal Constructions

Additionally, time is a valuable resource for all homeowners, therefore hiring a knowledgeable realtor will help you save time. And there are now numerous solutions that can assist all homeowners in finding a tenant in the most legitimate and legal way. A lump sum and an average cost must be included in the total budget because hiring a broker might be costly.

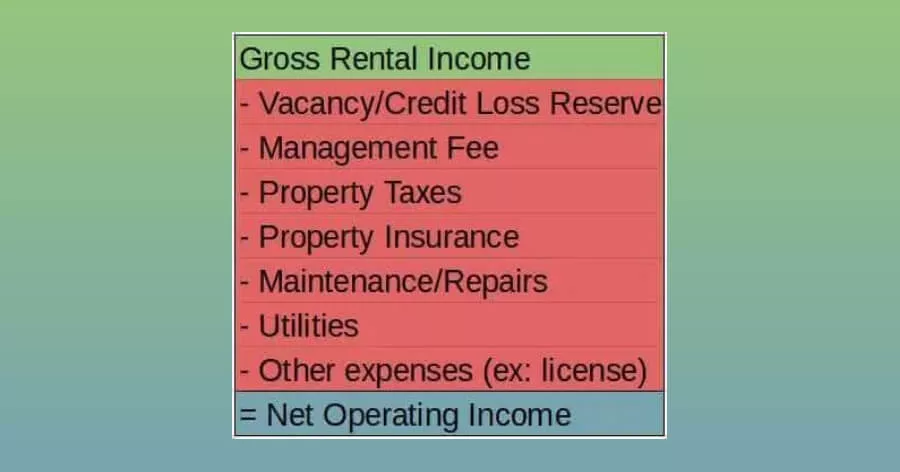

Ways to Calculate Expenses for a Rental Property

Along with the price of purchase, you should obtain a precise estimate of the costs related to maintaining your rental property. After all, if your expenses are equal to or greater than your anticipated return, your investment might not be profitable. Calculating expenses might be challenging due to unpredictable variables. But, here are some suggestions that can help you in calculating the cost of your rental property:

Talk to a Real Estate Agent or A Property Manager in The Area

Property managers and real estate agents are the best people to ask for precise information about your local market because they will be familiar with rental costs there. Call a few different property managers. Tell them you’re interested in hiring a manager, and while you’re talking to them, inquire about the entire cost of maintaining the property.

Prepare A Profit & Loss Statement

Investors can monitor the financial health and performance of rental properties using a profit and loss statement, or P&L. Property income, expenses, profits, and losses are included in the document. A P&L can be used by investors to pinpoint spending categories or places where costs might be reduced while profits are raised.

Conclusion

The important factor that all homeowners consider before renting out the property is the rental property expenses. Additionally, a lot of residences are currently being built in the countryside.

In addition, rental property has emerged as a key source of passive income. Despite the fact that it is a developing nation, the rate of construction is rising daily. As a result, all homeowners must manage their spending more effectively.

Read More: Best Fun Summer Activities for Your Kids in 2022

Moreover, a number of expenses, such as property taxes, upkeep, inspection, and utility costs must be included in the overall budget for the rental property. Professional advice is also required for that.

You can also invest in other famous and most in demand housing societies, such as , Blue World City, Rudn Enclave, 7 Wonders City Peshawar, Taj Residencia, Kingdom Valley, New Metro City Gujar Khan, Forest Town Rawalpindi, University Town Rawalpindi, ICHS Town, Park View City Islamabad, Multi Gardens B17 Islamabad and Nova City Islamabad.

Al Sadat Marketing please contact 0331 1110005 or visit https://alsadatmarketing.com/

Few more real estate housing schemes which are trending now a days in Islamabad by including: Faisal Town Phase 2, Prism Town Gujar Khan, New City Paradise, Eighteen Islamabad, 7 Wonders City Islamabad, Capital Smart City, Silver City Islamabad, The Life Residencia, Faisal Town Islamabad, Islamabad Golf City, Islamabad Model Town and Marble Arch Enclave.

Al Sadat Marketing is an emerging Real Estate Agency headquartered in Islamabad, Pakistan. With over 10+ Years of experience, Al Sadat Marketing is providing its services and dealing all trending housing societies projects in different cities of Pakistan. Islamabad Projects, Rawalpindi Projects, Gujar Khan Projects, Burhan Projects, and Peshawar Projects etc.

Book Your Plot Now: +92 331 111 0005